2024 1040 Schedule Email

2024 1040 Schedule Email – Complete IRS 1040 Schedule C, “Profit Or Loss From Business.” On the Schedule C, you are required to enter your name, Social Security number, business name (if applicable), business address . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 1040 Schedule Email

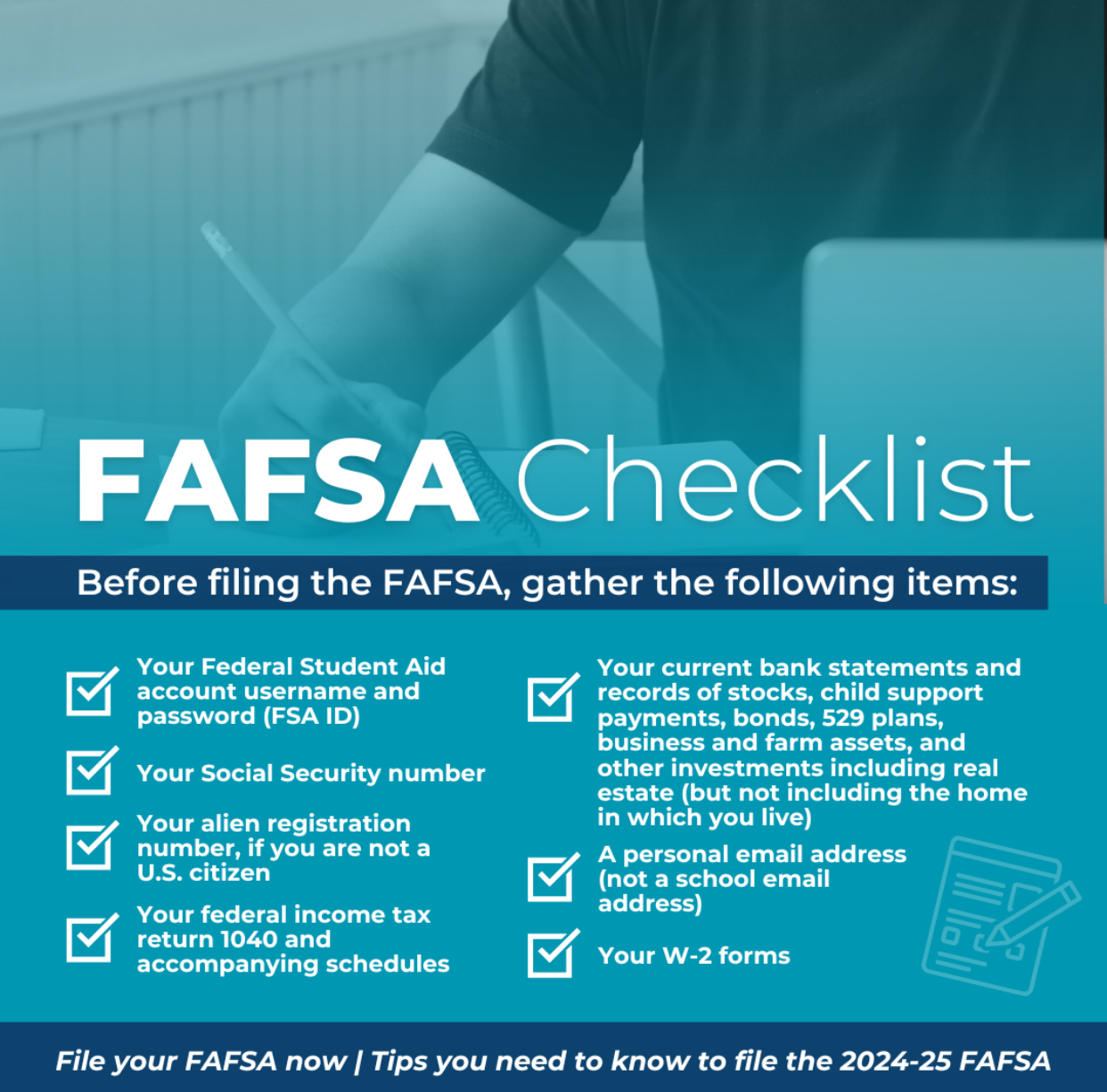

Rep. Dan Williams on X: “The 2024 2025 FAFSA form and information

When To Expect My Tax Refund? IRS Tax Refund Calendar 2024

IRS Refund Schedule 2024 Date to recieve tax year 2023 return!

News Flash • Lorain Income Tax Department

Financial expert: Year end money moves

Rep. Jeanne McNeill on X: “PHEAA has several upcoming webinars

Financial expert: Year end money moves

BGFS INC | Riverdale IL

Adventure Off Road Park

2024 1040 Schedule Email Business tax deadlines 2024: Corporations and LLCs | Carta: Hiring a CPA to do my taxes was worth the cost, but when they made a mistake on my tax return, I found out the hard way that they aren’t perfect. . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]> Posted in 2024